THE DATA EXCHANGE COOPERATIVE

Bigger Data,

Better Outcomes

Partner with other credit unions to share data for more informed decision making and predictive models

THE DATA EXCHANGE COOPERATIVE

Bigger Data,

Better Outcomes

Partner with other credit unions to share data for more informed decision making and predictive models

A Credit Union Data Exchange

The Future of Data for Credit Unions

Cooperative Model

Credit unions own the data exchange and govern through a cooperative model

Advisory Councils

Credit unions define standards for data governance, data privacy and security, and data use through Advisory Councils

Exchange Roadmap

Credit unions drive the exchange roadmap

Data Analytics

Credit unions participate by sharing a rich, anonymized, and analytically valuable data set

CUDX Blog

Check out the latest from the CUDX blog, where you can learn about CUDX and the importance of data in creating sights for your credit union.

CUDX Data Analytics Use Cases: From Concept to Value

How Will Data Privacy and Governance Work in CUDX?

CUDX Blog

Check out the latest from the CUDX blog, where you can learn about CUDX and the importance of data in creating sights for your credit union.

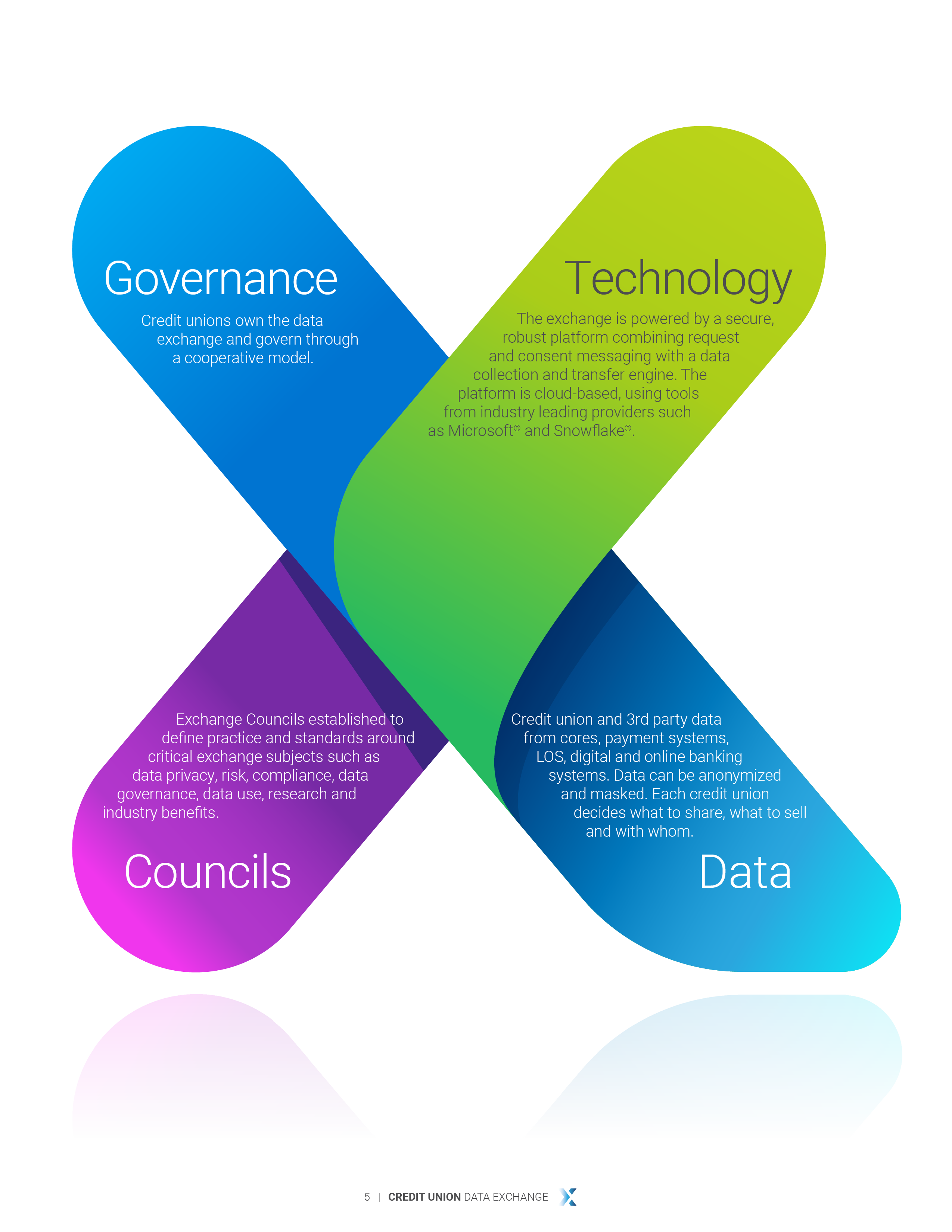

CUDX Elements

Credit unions collectively own and control CUDX through a cooperative model. This ensures that the exchange is always serving credit unions’ interests in a safe and controlled manner, according to credit union-derived standards. Each credit union individually controls their own data within the exchange.

Governance

Technology

Governance

test

CUDX Elements

Credit unions collectively own and control CUDX through a cooperative model. This ensures that the exchange is always serving credit unions’ interests in a safe and controlled manner, according to credit union-derived standards. Each credit union individually controls their own data within the exchange.

Governance

Credit Unions Own the data exchange and govern through a cooperative model.

Data

Credit union and 3rd party data from cores, payment systems, LOD, digital and online banking systems. Data can be anonymized and masked. each credit union decides what to share, what to sell and with whom.

Technology

The exchange is powered by a secure, robust platform combining request and consent messaging with a data collection and transfer engine. The platform is cloud-based, using tools from industry leading providers such as Microsoft* and Snowflake*.

Councils

Exchange Councils established to define practice and standards around critical exchange subjects such as data privacy, risk, compliance, data governance, data use, research and industry benefits.

The Future of Data for Credit Unions

CUDX Elements

Credit unions collectively own and control CUDX through a cooperative model. This ensures that the exchange is always serving credit unions’ interests in a safe and controlled manner, according to credit union-derived standards. Each credit union individually controls their own data within the exchange.

The Future of Data for Credit Unions

CUDX Elements

Credit unions collectively own and control CUDX through a cooperative model. This ensures that the exchange is always serving credit unions’ interests in a safe and controlled manner, according to credit union-derived standards. Each credit union individually controls their own data within the exchange.

Governance

Credit Unions Own the data exchange and govern through a cooperative model.

Data

Credit union and 3rd party data from cores, payment systems, LOD, digital and online banking systems. Data can be anonymized and masked. each credit union decides what to share, what to sell and with whom.

Councils

Exchange Councils established to define practice and standards around critical exchange subjects such as data privacy, risk, compliance, data governance, data use, research and industry benefits.

Technology

The exchange is powered by a secure, robust platform combining request and consent messaging with a data collection and transfer engine. The platform is cloud-based, using tools from industry leading providers such as Microsoft* and Snowflake*.

News + Media

Trellance Becomes First CUDX Customer, Providing 1-Year No Cost Access to First Credit Unions to Sign Up

August 22, 2023

Trellance is partnering with CUDX to build a data pool of over 4 million credit union members, providing valuable insights to credit unions

Thinking Forward: Top 11 Things Industry Leaders Think Credit Unions Should Watch Out for in 2024

January 25, 2024

January—‘tis the season when credit unions take a deep breath, shake off the holidays, and focus on the new year. To help set the stage, we spoke to credit union leaders and industry experts…

Trellance’s Adam Wright Shares Significance of CUDX for Credit Unions

October 15, 2023

Trellance’s Managing Director, Credit Union Data Exchange Operations Adam Wright joined us on the show to provide a quick update on CU Data Exchange (CUDX), a centralized platform that enables secure sharing and exchange of data among credit

The Credit Union Data Exchange

CUDX Prospectus

Got a question about CUDX? We have the answer! Read our Frequently Asked Questions page

Contact Us

Want to be a part of CUDX?

Fill out this form and we’ll reach out to you to begin the process.